Does Insurance Cover Mounjaro? Navigating Your Coverage for Weight Loss Treatment

Determining if insurance covers Mounjaro can be a critical concern for those prescribed this diabetes and weight loss medication. While coverage varies, most insurance companies do consider Mounjaro for those eligible. This article will help you navigate the often complicated insurance landscape and provide practical advice on how to confirm “does insurance cover Mounjaro” with your provider.

Key Takeaways

Insurance coverage for Mounjaro varies widely depending on the individual’s plan and what it includes in its Prescription Drug Formulary (PDF), with some requiring prior authorization.

Mounjaro is covered by some Medicare Part D plans and Medicaid for treating type 2 diabetes, though state policies determine its coverage for weight loss uses.

For those without full insurance coverage, options like the Mounjaro Savings Card, manufacturer discounts, patient assistance programs, and prescription savings cards like NiHowdy can help manage costs.

Exploring Insurance Coverage for Mounjaro

Regarding Mounjaro, a revolutionary drug for those managing type 2 diabetes and weight management issues, insurance coverage becomes a critical concern. The effectiveness of Mounjaro is well-documented. The extent to which it is covered by various insurance plans can differ greatly—impacting users’ experiences with this treatment significantly. To address these concerns about whether your insurance will cover Mounjaro and how to approach this issue effectively are vital—they dictate the amount you might have to spend on this essential medication.

In reality, there isn’t a universal answer when it comes to obtaining coverage for Mounjaro under an insurance policy since each specific plan adheres to its unique guidelines regarding what treatments or medications are eligible for coverage. Therefore, understanding your particular health plan offered by your insurer is imperative. A good beginning step would be examining the prescription drug list that pertains directly to your individualized insurance plan.

Checking Your Health Plan’s Prescription Drug List

To ensure you are getting the most out of your pharmacy benefits, including prescription drug coverage, examine your specific plan’s Prescription Drug Formulary (PDF). This essential document delineates which drugs are covered under your insurance and is applicable whether you have health insurance through the Health Insurance Marketplace, a small business program such as SHOP, or a group plan. The PDF will indicate if medications like Mounjaro are part of the bounty included in your coverage. It’s crucial to understand how these prescription drug lists operate to fully leverage your benefits.

The placement of drugs into various tiers within this list can significantly influence their cost levels for you. So how do you access this important information? Simply log on to your insurer’s website or make a direct phone call for clarity. For instance, UnitedHealthcare members might sign into myuhc.com or dial the number provided on their membership ID card to check if Mounjaro is listed among their covered medications—a fundamental yet easy step that could affect both treatment options and expenses related to prescriptions.

Understanding Prior Authorization for Weight Loss Medications

If Mounjaro is included in your Prescription Drug Formulary (PDF), that’s excellent news. You might still encounter the requirement for prior authorization. This step is fairly standard with many insurance policies, particularly concerning weight loss drugs. Basically, prior authorization acts as an approval process from your insurer after they consider your individual medical situation and how the drug will be used. For individuals aiming to shed pounds, medications like Mounjaro are beneficial, especially since qualifying often depends on being overweight along with having associated health conditions such as high cholesterol.

Be aware that although Medicaid programs must provide coverage for FDA-approved medications, they have the discretion to omit those prescribed solely for losing weight. This can influence whether certain uses of Mounjaro will be covered by insurance or not. The details regarding Medicaid coverage vary greatly and understanding how your plan handles prior authorizations could prevent unforeseen expenses in the future.

The Role of Your Health Care Professional

Securing insurance coverage for Mounjaro involves more than just financial considerations—it’s a collaborative process involving you and your health care professional. Since you can’t obtain this weight loss medication without a prescription, your health care professional is key in initiating treatment by prescribing the drug according to what your insurance company requires for coverage. They are crucial in providing all relevant documentation—including diagnoses, records of treatment, and details of a planned approach to losing weight—which may be vital to fulfill the criteria set by your insurance.

Should you have any additional inquiries or reservations, it is important to consult with your doctor who can offer detailed information concerning how Mounjaro might impact you personally and ascertain if it falls within the benefits provided by your specific health care plan. Your doctor will address these concerns directly related to both medical advice regarding its usage as well as aspects of its coverage under an existing insurance policy.

Medicare and Mounjaro: Are You Covered?

As someone who benefits from Medicare, you may have questions about the availability of coverage for Mounjaro. Regrettably, due to stipulations that prevent participants in government programs like Medicare from using it, you won’t be able to take advantage of the Mounjaro Savings Card. This doesn’t mean there are no other options available to you. Under Medicare Part D – which is designated for covering prescription drugs – it’s possible that your specific plan might provide coverage for Mounjaro depending on its formulary list. To increase accessibility and reduce costs, it’s beneficial for those with Medicare to explore whether their particular policy includes this drug.

If financial concerns persist regarding medication expenses under Medicare Part D plans, assistance programs such as Extra Help could offer additional aid to eligible individuals. Diligently researching and gaining a thorough understanding of your own Medicare plan will help determine what support can be leveraged when seeking these types of medications.

Medicaid’s Stance on Mounjaro Coverage

When examining Medicaid, we find a differing landscape of coverage. As a program administered by individual states, Medicaid provides an assortment of coverage options that differ significantly throughout the United States. For type 2 diabetes treatment, Mounjaro is included in Medicaid’s coverage. When prescribed specifically for weight loss purposes, its inclusion relies on varying state-level policies.

There is an emerging trend where some states are considering expanding their benefits to include medications designed for weight management. This could potentially influence how Mounjaro fits within both Medicaid and large group insurance plans. To obtain comprehensive understanding regarding what one might anticipate about benefits availability and related expenses with these plans, it’s beneficial to consult the UHC Community Plan website—particularly navigating through the pharmacy benefits area will yield Intricate details on this topic.

Private Insurance and Mounjaro: What to Expect

If you are under a private insurance plan, the situation differs. Private insurance carriers, including companies like Kaiser Permanente, often cover medications approved by the FDA for weight loss. Consequently, if your insurance falls into this category and Mounjaro is part of its formulary—being an FDA-approved medication for type 2 diabetes that’s also used to aid in weight loss—you may have coverage for it. To ascertain what options are available regarding coverage of these medications, consulting with your insurance provider is essential.

Additional Ways to Manage Mounjaro Costs

In the event that Mounjaro is not included under your health plan or if insurance offers limited coverage, consider exploring other avenues to alleviate the medication costs. Here are a few strategies you might pursue.

Eligible patients can benefit from the Mounjaro Savings Card, which could reduce out-of-pocket expenses to an amount as low as $25 for either one or three months’ supply of this prescription. Note that there are expiration limitations on this card and it’s not accessible to individuals participating in government-sponsored healthcare programs.

Reaching out directly to Mounjaro’s manufacturer may reveal patient assistance programs or discounts they provide.

Discussing with your healthcare provider about alternative medications or treatment paths could lead you toward more budget-friendly solutions.

Investigate various prescription support initiatives and organizations willing to offer financial aid towards your Mounjaro prescriptions.

It’s crucial to address any financial concerns regarding treatment with your healthcare provider. They can assist in navigating toward optimal solutions tailored for you personally.

For uninsured individuals, as well as those whose insurance does not cover treatments like Mounjaro within their plans, applying for patient-assistance schemes is pivotal – these resources are designed specifically to make such medications financially accessible for adult patients seeking help.

Financial Benefits of Discount Programs

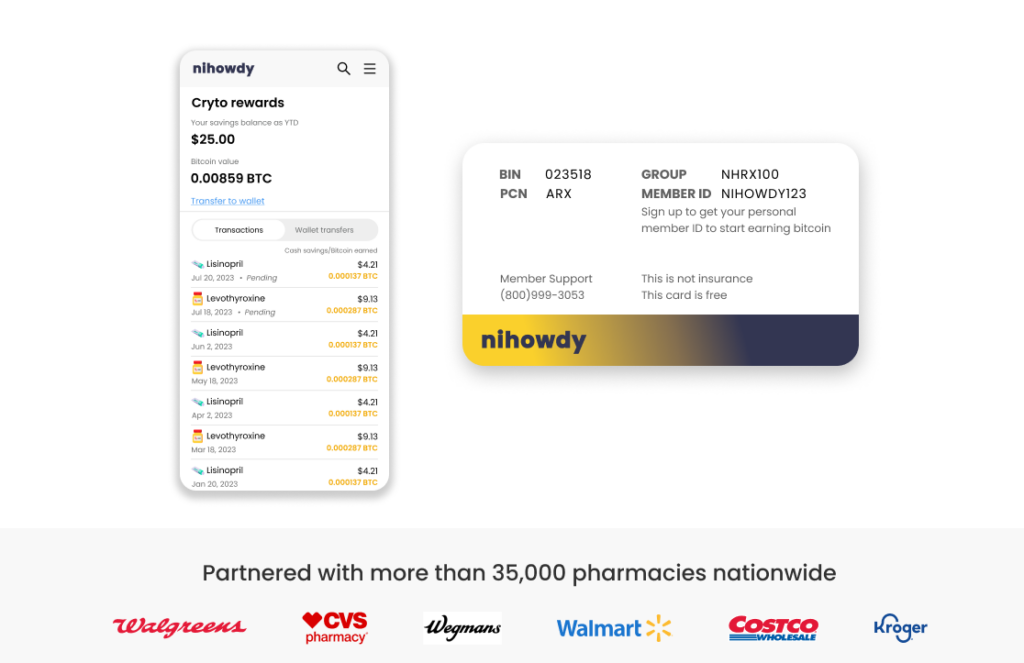

Imagine having a tool that not only reduces the cost of your current prescriptions, but also contributes to your long-term financial well-being. NiHowdy introduces an innovative solution within the pharmacy benefits sphere with their prescription savings card. This service is straightforward: by using NiHowdy’s card at any participating pharmacy, customers enjoy on-the-spot discounts for medications including Mounjaro and simultaneously accrue up to 3% back in Bitcoin for each transaction they make. Such an offering delivers immediate financial relief when paying for prescriptions while presenting an opportunity for investment growth over time—creating a safety net against escalating medical expenses.

This method represents a progressive strategy in handling medication costs. It seeks to enhance one’s fiscal health multi-dimensionally by focusing on leveraging the same active ingredient principle.

Summary

In navigating the terrain of insurance coverage for Mounjaro, it’s essential to take an active and informed approach. Make sure you’re familiar with your health plan’s prescription drug list, understand the process of prior authorization, and recognize the significant role played by healthcare professionals. If you are covered by Medicare or Medicaid, being well-versed in your specific coverage details is imperative. Those with private insurance might experience more leeway. Savings cards and programs such as NiHowdy’s provide a glimmer of hope when facing high out-of-pocket expenses. Ultimately, there exists a variety of strategies to manage the costs associated with your Mounjaro prescription—and armed with proper knowledge, you can identify effective solutions tailored to suit your individual needs within this complex landscape of insurance and medication costs.

Frequently Asked Questions

Is Mounjaro covered by health insurance for weight loss treatment?

Insurance coverage for Mounjaro as a treatment for weight loss differs from one insurer to another. It is essential to verify with your particular insurance provider whether they offer coverage, which may be contingent upon meeting specific requirements.

How can I find out if Mounjaro is on my Prescription Drug List?

To determine whether Mounjaro is included in your health plan’s prescription drug list, log into the website of your health plan or dial the customer service number located on your health plan identification card.

By doing so, you will obtain reliable and current details about the coverage for this particular drug under your prescription.

What is prior authorization, and how does it affect my access to Mounjaro?

The procedure known as prior authorization involves your insurance company conducting a review and granting approval for coverage of specific medications, contingent on the medical need.

Particularly in cases where Mounjaro is prescribed with the aim of weight loss, securing prior authorization frequently becomes essential to confirm that it is included under insurance coverage.

Are there any cost-saving programs available for Mounjaro if I’m on Medicare or Medicaid?

The Mounjaro Savings Card is probably not compatible with Medicare or Medicaid. Select Medicare Part D plans might include coverage for Mounjaro. The Extra Help program under Medicare Part D may provide financial support.

Coverage for Medicaid differs across states. Hence it’s advisable to consult your specific state’s program regarding this matter.

Can discount programs like NiHowdy’s prescription savings card really help manage medication costs?

Indeed, NiHowdy’s prescription savings card can assist in controlling medication expenses by providing instant discounts on medications and also offers the chance to accumulate Bitcoin rewards with every purchase for prospective future cost reductions.