Empowering the Uninsured: How NiHowdy Brings Investment Ownership to Prescription Buyers

Introduction

As a pharmacist, I’ve spent years observing a troubling pattern: many people who buy prescriptions out-of-pocket lack health insurance and suffer from poor health equity. Beyond the immediate strain of high medication costs, these individuals often lack ownership of assets like stocks or Bitcoin, further widening the gap in financial stability. My experience underscores an essential point—without health insurance, the pathway to investment ownership and long-term financial security is often out of reach. However, solutions like NiHowdy can change this narrative by leveraging drug rebates to provide these individuals with Bitcoin, paving the way for better health and financial equity.

Key Takeaways:

Many People Struggle Without Insurance: Patients who pay for prescriptions out of pocket often don’t have health insurance, making it harder for them to afford healthcare and build wealth.

Fewer Investments for the Uninsured: People without insurance usually don’t own assets like stocks or Bitcoin, limiting their financial growth.

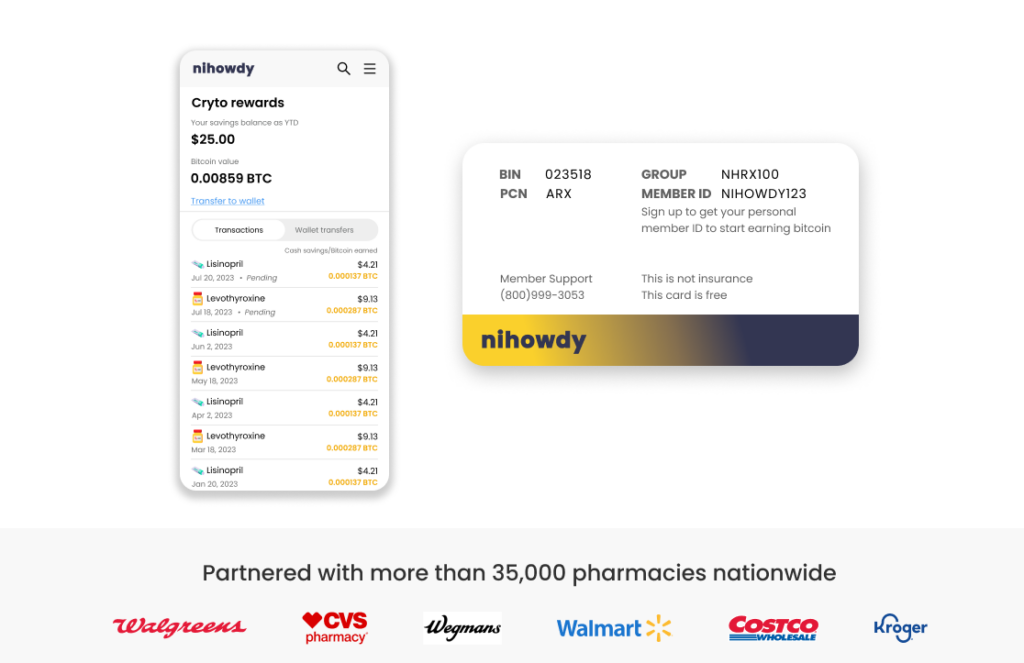

NiHowdy’s Solution: NiHowdy turns drug rebates into Bitcoin or stock rewards, allowing people to invest and grow wealth from their prescription purchases.

Why Bitcoin Matters: Bitcoin is easy to access and has the potential to grow in value over time, making it a great way for people to start investing, even with little money.

Closing the Gap: NiHowdy helps people without insurance turn everyday savings into investments, building financial security and improving health equity.

The Financial Reality of the Uninsured

In my practice, I often witnessed patients struggling to pay for essential medications, particularly those without health insurance. The statistics are revealing. According to Gallup, 84% of households earning over $100,000 own stocks, while only 22% of those earning less than $40,000 do. This disparity directly correlates to health insurance coverage; higher-income individuals are more likely to be insured and own growth assets.

A recent Unchained study highlighted that 26% of Americans own Bitcoin, with ownership more prevalent among higher-income groups. This aligns with data from the U.S. Census Bureau, confirming that higher incomes are more likely to have comprehensive healthcare coverage. This divide indicates that individuals without health insurance struggle with healthcare costs and miss out on opportunities for financial growth through asset ownership.

The Equity Gap in Asset Ownership

Asset ownership is a critical measure of financial stability and future wealth. However, uninsured people often have lower financial literacy and fewer opportunities to invest in growth assets like stocks and Bitcoin. This results in a cycle where individuals remain excluded from wealth-building channels, further deepening financial insecurity.

NiHowdy’s Vision for Change

NiHowdy aims to disrupt this cycle by converting drug rebates into investments. Our platform enables prescription buyers to earn Bitcoin or stock rewards from the rebates they would typically miss out on. By doing so, NiHowdy empowers individuals who often face financial hardships to build an investment portfolio, even if they lack traditional healthcare coverage.

Why Bitcoin?

Bitcoin is an ideal entry point for individuals new to asset ownership due to its accessibility and growth potential. In my previous article, “Understanding Drug Prices on a Bitcoin Standard: A New Perspective,” I noted that the cost of brand name drugs dropped by 61% in Bitcoin terms between 2018 and 2024, even as their fiat price increased by 76%. This shift underscores Bitcoin’s potential as a tool for delayed gratification and long-term financial benefit. By offering rebates in Bitcoin, NiHowdy allows patients to accumulate a potentially appreciating asset, providing a financial cushion that can offset future healthcare costs.

Real-Life Implications

Imagine a patient purchasing medication out-of-pocket through NiHowdy. Instead of just covering the cost, they receive a portion of their payment back as Bitcoin. Over time, these rebates accumulate and grow in value, providing them with a financial reserve that was previously out of reach. This model creates a seamless way to build wealth passively for those who may struggle to save or invest due to immediate expenses.

Conclusion

The connection between lacking health insurance and low asset ownership is evident. Without strategic interventions, many will continue to fall behind. NiHowdy offers a novel solution, turning drug rebates into opportunities for investment ownership. By leveraging the growth potential of Bitcoin and other assets, we can help bridge the gap for those who need it most, fostering both financial and health equity.

References

Gallup data on stock ownership by income level.

Unchained study on Bitcoin ownership demographics.

U.S. Census Bureau data on income and health insurance coverage.

Article: “Understanding Drug Prices on a Bitcoin Standard: A New Perspective.”