Understanding Bitcoin: A Comprehensive Guide

Welcome to the world of Bitcoin – a decentralized digital currency that has captivated the minds of investors, technologists, and everyday users. As a groundbreaking innovation with the potential to revolutionize global finance, understanding how Bitcoin works is a fascinating subject to explore. In this comprehensive guide, we will delve into the history, technology, and practical applications of Bitcoin, helping you grasp the basics and navigate the ever-evolving landscape of digital currency. So, buckle up and get ready to embark on an exciting journey into the world of Bitcoin!

Image source: Canva Pro

Key takeaways

Key takeaways

- Bitcoin is a decentralized digital currency enabling peer-to-peer transactions with blockchain technology.

- Satoshi Nakamoto’s revolutionary work in creating Bitcoin has sparked a technological revolution.

- Investing in Bitcoin involves careful consideration of price volatility, security risks and potential for growth and long-term value appreciation.

Grasping the Basics of Bitcoin

At its core, Bitcoin is a decentralized digital currency that enables peer-to-peer transactions without the need for intermediaries like banks or governments. This innovative approach to financial transactions has the potential to disrupt traditional monetary systems and offer a more inclusive alternative to fiat currencies. But how does Bitcoin work, and how is it different from traditional assets? We’ll begin by delving into bitcoin basics and into its origins.

The Genesis of Bitcoin

Bitcoin’s inception dates back to 2008, when the domain Bitcoin.org was registered, marking the beginning of a new era in digital money. The pseudonymous creator, Satoshi Nakamoto, released the whitepaper and the initial version of the Bitcoin software in 2009. This groundbreaking work laid the foundation for a decentralized network that records every transaction on a public ledger called the blockchain.

The inaugural Bitcoin block, referred to as the “genesis block,” came into existence on January 3, 2009, indicating the inception of the first Bitcoin side ledger.

Decentralization and Digital Currency

Decentralization is a key feature of Bitcoin, as it eliminates the need for central authorities like banks to process transactions. Instead, the power and control are dispersed throughout the entire Bitcoin network, allowing users to transact directly with one another. This decentralization is made possible by the blockchain – a transparent and tamper-proof digital ledger that records all Bitcoin transactions.

The elimination of the third party in Bitcoin transactions expedites and reduces the cost of transfers, with Bitcoin holders thereby positioning it as an appealing alternative to conventional currencies.

3, 2009, indicating the inception of the first Bitcoin side ledger.

The Role of Satoshi Nakamoto

The mysterious creator of Bitcoin, Satoshi Nakamoto, developed the open-source software and protocol that powers the cryptocurrency. Although the true identity of Nakamoto remains unknown, their groundbreaking work has sparked a technological revolution and inspired countless developers, entrepreneurs, and investors worldwide.

The creation of a decentralized digital currency functioning without central bank authorities by Nakamoto not only disrupted the existing financial system but also ushered in a novel era in digital finance.

Unraveling the Bitcoin Network

The Bitcoin network relies on the bitcoin protocol, a combination of peer-to-peer transactions, blockchain technology, and robust security measures to function effectively. To maintain the integrity of the network, Bitcoin miners validate transactions and append them to the blockchain, receiving rewards for their efforts.

Bitcoin’s scarcity, attributed to its supply limit of 21 million coins, adds to its value and allure as a digital currency. We’ll now delve deeper into the mechanics of the Bitcoin network.

Peer-to-Peer Transactions

One of the key features of Bitcoin is its ability to facilitate direct transactions between users without the need for intermediaries like a bank or governments. This peer-to-peer approach enables faster and more cost-effective transfers, making Bitcoin an attractive alternative to traditional payment methods, including bitcoin payments and bitcoin transactions.

In order to maintain the accuracy and security of the network, Bitcoin transactions are verified by nodes – computers that participate in the network and maintain the transaction ledger.

Blockchain: The Backbone of Bitcoin

Blockchain technology serves as the foundation of Bitcoin, providing a transparent and immutable ledger of all transactions. Each block in the blockchain contains a series of transactions, with every new block linked to the previous one through a cryptographic hash. This creates a secure and tamper-proof record of the entire transaction history, ensuring the integrity of the Bitcoin network.

Adding a block to the blockchain requires miners to validate transactions and attain consensus, thereby enhancing the security of the system.

Verification and Security Measures

The Bitcoin network employs various verification and security measures to ensure the integrity of transactions and protect users from fraud and other malicious activities. These measures include the use of encryption algorithms, consensus mechanisms, and public verification processes, such as the Proof of Work system employed in Bitcoin mining. By adhering to these strict security protocols, the Bitcoin network maintains a high level of trust and reliability, making it an attractive option for users and investors alike.

The Process of Bitcoin Mining

Bitcoin mining is the process of validating transactions between bitcoin addresses and adding them to the blockchain, with miners receiving rewards for their efforts. This not only ensures the security and integrity of the Bitcoin network but also plays a crucial role in the creation of new bitcoins.

A deeper understanding of Bitcoin mining necessitates a detailed look into the Proof of Work system, incentives for miners, and the obstacles inherent in the process.

Proof of Work Explained

Proof of Work is the consensus mechanism used in Bitcoin mining, requiring miners to solve complex mathematical problems to validate transactions. This process ensures that only legitimate transactions are added to the blockchain, while also making it computationally difficult for malicious actors to tamper with the transaction history.

The first miner to successfully solve the problem is rewarded with newly minted bitcoins and transaction fees, incentivizing miners to contribute their computing power to the network.

Blockchain: The Backbone of Bitcoin

Blockchain technology serves as the foundation of Bitcoin, providing a transparent and immutable ledger of all transactions. Each block in the blockchain contains a series of transactions, with every new block linked to the previous one through a cryptographic hash. This creates a secure and tamper-proof record of the entire transaction history, ensuring the integrity of the Bitcoin network.

Adding a block to the blockchain requires miners to validate transactions and attain consensus, thereby enhancing the security of the system.

Miner’s Incentives and Rewards

Miners play a vital role in the Bitcoin network, helping to maintain its security and integrity by validating transactions and appending them to the blockchain. In return for their efforts, miners are rewarded with newly minted bitcoins and transaction fees. This incentive system not only compensates miners for their work but also encourages more participants to join the network, further strengthening its security and reliability.

Challenges and Environmental Concerns

Bitcoin mining faces several challenges, including high energy consumption and environmental concerns. The process requires a significant amount of computing power, leading to increased energy usage and potential adverse effects on the environment. As a result, there is ongoing debate about the sustainability of Bitcoin mining and the need for alternative consensus mechanisms to reduce its environmental impact.

Managing Your Bitcoins: Wallets and Storage

Managing bitcoins involves using digital wallets to store and secure the cryptocurrency, with various options available to suit individual needs and preferences. These wallets allow users to send, receive, and store their bitcoins, while also providing essential security features to protect against theft and unauthorized access, similar to a traditional bank account. As an alternative to using digital wallets, some users may choose to mine new bitcoin themselves, which involves using specialized hardware and software to solve complex mathematical problems in exchange for new bitcoins. In this way, bitcoin can also serve as a store of value for those who invest in it.

In this section, we will explore the different types of wallets and their respective features, helping you choose the best way to manage your bitcoins.

Hot Wallets vs. Cold Wallets

Hot wallets are connected to the internet, offering convenience and accessibility, while cold wallets provide offline storage for enhanced security. Hot wallets are typically more user-friendly and suitable for frequent transactions, whereas cold wallets are ideal for long-term storage and safeguarding of cryptocurrencies.

Choosing a wallet necessitates the consideration of factors like security, convenience, and individual preferences, enabling you to find the most suitable solution.

Private Keys and Security

Private keys are essential for securing and accessing one’s bitcoins, requiring careful management and protection. These unique alphanumeric codes function similarly to passwords, authorizing transactions and verifying ownership of cryptocurrency funds. To ensure the security of your private keys, it is crucial to store them in a secure location, make backups, and employ strong passwords and two-factor authentication

Choosing the Right Wallet for You

Choosing the right wallet depends on factors such as security, convenience, and personal preferences. With a variety of wallet types available, including hot wallets, cold wallets, hardware wallets, and paper wallets, it is essential to evaluate their security features, user experience, and compatibility to find the best option for your needs.

Additionally, consider the company reputation and customer support when selecting a wallet provider to ensure a smooth and secure experience.

Buying, Selling, and Using Bitcoin

Bitcoin can be bought, sold, and used for various purposes, including payments and investments. With numerous platforms and methods available to buy bitcoin and dispose of them, it is essential to understand the process and options available to maximize your experience.

This section will guide you through various methods of buying, selling, and utilizing traditional currencies with Bitcoin, thereby supporting informed decisions in the realm of digital currency.

Purchasing Bitcoin: Exchanges and Brokers

Purchasing bitcoin involves using cryptocurrency exchanges or brokers, with various platforms available to suit different needs and preferences. Exchanges are platforms where users can buy, sell, and trade Bitcoin for other cryptocurrencies or fiat currencies, while brokers facilitate direct cryptocurrency transactions, between buyers and sellers.

Some of the widely-used Bitcoin exchanges include:

- Coinbase

- Kraken

- Gemini

- Binance

It is crucial to consider factors such as fees, security, and ease of use when selecting a platform to buy or sell Bitcoin.

Selling Bitcoin for Fiat Currency

Selling bitcoin typically involves the following steps:

- Convert it to fiat currency through exchanges or other platforms.

- Locate an exchange or platform that supports the conversion.

- Create an account and provide the required details to complete the transaction.

- Once the transaction is completed, the fiat currency will be deposited into your account.

When selecting a platform for selling Bitcoin, it is essential to consider factors such as fees and security.

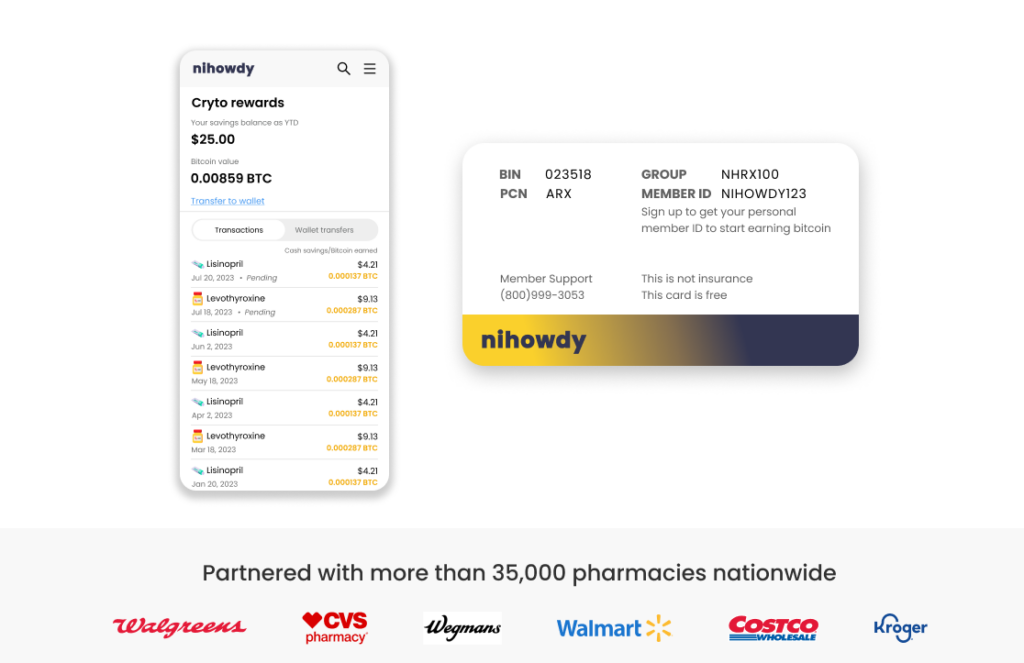

Bitcoin as a Payment Method and Investment Vehicle

Bitcoin can be used as a payment method at select merchants and as an investment vehicle, with its potential for growth and long-term value attracting investors. As the adoption of Bitcoin continues to grow, more businesses are beginning to accept bitcoin as a form of payment for goods and services, providing users with a convenient and secure alternative to traditional payment methods such as credit card. To use bitcoin for transactions, ensure that the merchant accepts this form of electronic payment system.

Additionally, Bitcoin’s potential for growth and value appreciation makes it an attractive investment option for those looking to diversify their portfolios and capitalize on the cryptocurrency’s potential.

The Legality and Regulation of Bitcoin

The legality and regulation of Bitcoin vary across countries, with governments grappling with the challenges of balancing innovation and security. With the rising popularity of Bitcoin, nations globally are formulating regulatory structures to tackle the distinct challenges brought about by this decentralized digital currency.

This section will:

- Delve into Bitcoin’s legal standing across different jurisdictions

- Scrutinize the regulatory hurdles encountered by governments

- Emphasize the necessity of maintaining equilibrium between innovation and security.

Bitcoin’s Legal Status Across Countries

Bitcoin’s legal status differs from country to country, with some embracing the technology and others imposing restrictions or bans. In many developed countries, such as the United States, the United Kingdom, Germany, Japan, and Switzerland, Bitcoin is legally recognized and regulated. However, the specific regulations and use cases for Bitcoin may differ within each country, making it essential for users to be aware of the local laws and regulations governing the use of Bitcoin in their jurisdiction.

Regulatory Challenges and Compliance

Regulatory challenges include ensuring compliance with anti-money laundering and counter-terrorism financing laws while fostering innovation in the cryptocurrency space. Governments and regulators must balance the need to protect consumers and prevent illicit activities with the desire to encourage technological advancements and economic growth. This can be achieved by providing clear guidance on existing regulations, establishing incentives for innovation, and engaging in open dialogue with industry stakeholders.

Balancing Innovation and Security

Striking the right balance between regulation and innovation is crucial for the continued growth and adoption of Bitcoin and other cryptocurrencies. Regulators must ensure that the technology is secure and reliable while also allowing for the introduction of new features and enhancements that can benefit users and drive the industry forward.

By adopting a balanced approach, governments can promote innovation while maintaining the integrity and security of the cryptocurrency ecosystem.

Risks and Rewards of Investing in Bitcoin

Investing in Bitcoin carries both risks and rewards, with factors such as price volatility, security threats, and potential for growth influencing investment decisions. As with any investment, it is essential to carefully consider the potential benefits and risks before making a decision.

This section endeavors to unveil the diverse factors that can influence the value of your Bitcoin investment, thereby assisting you in making knowledgeable choices within this volatile marketplace.

Price Volatility and Market Fluctuations

One of the primary risks associated with investing in Bitcoin is its price volatility, which can lead to significant losses for investors seeking short-term gains. Market fluctuations can be unpredictable, making it challenging to accurately forecast Bitcoin’s price in the future.

Conversely, certain investors might perceive this volatility as a chance to profit from short-term price fluctuations

Security Risks and Hacking Threats

Security risks, such as hacking and theft, can impact the value of one’s investment in Bitcoin, necessitating robust security measures to protect against these threats. Ensuring the security of your Bitcoin wallet and private keys is crucial to safeguard your investment and prevent unauthorized access to your funds.

Additionally, it is essential to be aware of potential scams and fraudulent activities in the cryptocurrency space, as well as the risks associated with using unregulated platforms and services.

Potential for Growth and Long-Term Value

Despite the risks, Bitcoin’s potential for growth and long-term value attracts investors seeking to diversify their portfolios and capitalize on the cryptocurrency’s potential. As the adoption of Bitcoin continues to grow and its use cases expand, its value may increase over time. Additionally, the decentralized nature of Bitcoin and its limited supply contribute to its appeal as a potential long-term investment.

Nonetheless, prudent considerations of your financial objectives, risk capacity, and investment timeframe are indispensable before venturing into Bitcoin investment.

Summary

In conclusion, Bitcoin is a groundbreaking innovation with the potential to transform the world of finance and redefine how we transact and invest. From its humble beginnings as the brainchild of a mysterious creator to its current status as a global phenomenon, Bitcoin continues to capture the imagination and interest of millions worldwide. By understanding the fundamentals of Bitcoin, its underlying technology, and the opportunities and risks associated with investing in it, you can make informed decisions and navigate the ever-evolving landscape of digital currency with confidence and clarity.

Frequently Asked Questions

How do beginners explain Bitcoins?

Bitcoin is a decentralized digital currency, developed by Satoshi Nakamoto, and based on a peer-to-peer network and Proof of Work consensus mechanism. It is a virtual currency that exists outside of any one person, group, or entity’s control, allowing for fast, secure transfers from anywhere in the world. Each Bitcoin is a digital asset stored in a cryptocurrency exchange or wallet, representing its current value and can be bought and sold in partial shares.

How does Bitcoin make you money?

Bitcoin can be used to make money through trading, buying and holding, affiliate marketing, accepting payments, staking/yield farming, lending, and exchanging for fiat currency. Each option has its own stipulations or risks, making it important to do your research before investing.

What happens if you invest $100 in Bitcoin today?

Investing $100 into Bitcoin today could yield solid gains if the market trends continue, however this is a risky investment given the volatile nature of cryptocurrencies. Many people opt to start with smaller amounts in order to limit their risk exposure.

What is the difference between a hot wallet and a cold wallet?

Hot wallets are connected to the internet and provide easy access, while cold wallets offer increased security through offline storage.